When a cardholder buys something from a Shopify business and then files a transaction dispute with the issuing bank, the transaction may result in a Shopify chargeback. As a result, a combination of sales reversals, fees, and additional labor could cause your business to lose money.

By using techniques and technologies that enhance the customer experience, combat fraud, and support you in winning disputes, you may prevent chargebacks on Shopify by following the precise instructions in this tutorial.

What is Shopify?

Using the ecommerce platform Shopify, businesses can sell goods online. Shopify is a platform that merchants can use to quickly and easily build an online storefront, market their items, and develop their ecommerce business.

As a platform, Shopify also allows extra features and third-party applications that aid in the expansion and scaling of enterprises. Merchants get access to the following resources in addition to the hosted online shop and point-of-sale app:

- Processing of payments, including the capacity to accept all common payment methods in more than 133 different currencies

- Customers can add purchased products to shopping carts using the Shopify checkout.

- Using shipping setup, retailers may streamline and simplify order fulfillment.

- access to a mobile app that allows business owners to manage their Shopify stores on the go

- Analytics and reports that give retailers knowledge and information to aid in decision-making

- Tools for marketing that assist businesses in connecting with their target audience and monitoring advertising campaigns

- the capacity to constantly alter your storefront’s appearance and features thanks to complete access to HTML, CSS, a feature-rich content management system, and apps

Using Shopify makes starting an ecommerce business easier. The platform can assist small firms or dropshippers in getting off the ground quickly and with a low initial expenditure, despite the fact that it has both benefits and drawbacks.

Process for Shopify Chargebacks

Any company that accepts credit cards runs the risk of getting a chargeback, and Shopify sellers are no exception. Fortunately, the chargeback procedure with Shopify is the same as it would be with any other payment processor.

STEP ONE

Receive the Chargeback

When a customer raises a dispute regarding a purchase, a chargeback may result. A client may start a chargeback for the following reasons:

- Not receiving a product after placing an order

- Receiving a faulty product

- Not being able to identify your billing description on a statement

- Forgetting the initial purchase

- Forgetting to end a recurring subscription

- Buying the item by mistake

- Criminal fraud, when an unauthorized third party uses a customer’s card.

The disputed amount is taken out of your merchant account and given back to the cardholder when a cardholder files a chargeback against you.

Your chargeback-to-transaction ratio will be impacted by receiving a chargeback. Your ability to accept credit cards may be suspended, and your fees can be up, if your chargeback percentage is too high.

STEP TWO

Reply the Chargeback

When you get a chargeback, you have two choices:

- Embrace the chargeback. The loss of revenue will last forever.

- fend off the chargeback. If you prevail, you’ll get back the money you lost.

How do you decide whether to answer or not? We advise you to examine these three items:

- The amount of a chargeback. Will your recovery outweigh the cost of the fight? In that case, go for it! If not, you ought to presumably assume responsibility. Not wanting to produce a poor return on investment (ROI).

- The due date for chargeback responses. Has the time for responses passed? If not, strike back! Admit responsibility if it has. If the case has already run its course, you cannot win.

- Your supporting documents. Do you have adequate proof to back up your claims? If so, you have a chance to prevail. However, your chances of success are slim if you don’t have the papers that the card brand requires for the specified reason code.

You’ll need to prepare a chargeback response if you want to fight.

On the Orders page of your Shopify admin panel, if you utilize Shopify Pay, you may access, review, and react to chargebacks.

Following receipt of your submission, the cardholder’s bank will assess your claim and any supporting materials to establish culpability. Your revenue is lost if the bank rules in favor of the cardholder. The money will instead be transferred back to your merchant account if the bank rules in your favor.

STEP THREE

Review the Financial Impact

Chargebacks may significantly affect your revenue. The value of the transaction will be credited to you if you contest and prevail in a chargeback, but you will likely still be charged a chargeback fee.

The value of the transaction will not be reimbursed to you if you agree to a chargeback or are unsuccessful in your defense against one. To make matters worse, there will still be a chargeback fee imposed upon you.

Although chargeback procedures are governed by card brands, your payment processor may handle fees differently. Fees and chargeback amounts are often deducted from your merchant account. Chargebacks are subtracted from your subsequent compensation if you utilize Shopify Payments, the company’s application for processing payments.

If the total amount of the chargeback cannot be covered by your payout, then…

- On the day of the payout, your bank account will be debited for the chargeback balance (for merchants in the U.S., Canada, and Australia).

- The remaining chargeback sum is subtracted from successive payouts until it is fully reimbursed (for merchants in Austria, Denmark, Germany, Hong Kong SAR, Ireland, Italy, The Netherlands, New Zealand, Singapore, Spain, Sweden, and the U.K.).

Chargeback fees for Shopify

You’ll be charged a chargeback fee after getting a chargeback. Your merchant service agreement specifies this amount, which is typically nonrefundable even if you prevail in the chargeback dispute.

Chargeback costs for Shopify Payments customers are:

If you use Shopify Payments, chargeback fees are:

| Country | Shopify Payments Chargeback Fee |

|---|---|

| Australia | 25 AUD |

| Canada | 15 CAD |

| Austria, Belgium, Denmark, Germany, Italy, The Netherlands, and Spain | 15 EUR |

| Ireland | 15 EUR plus 23% VAT |

| Hong Kong SAR | 85 HKD |

| Japan | 1,300 JPY |

| New Zealand | 20 NZD |

| Singapore | 15 SGD |

| Sweden | 15 EUR or 150 SEK (based on payment currency) |

| United Kingdom | 10 GBP |

| United States | 15 USD |

Chargeback fees vary based on the processor you use and are processor-specific. If you use a payment processor other than Shopify Payments, any chargeback costs you pay may be different.

Shopify Fraud Prevention

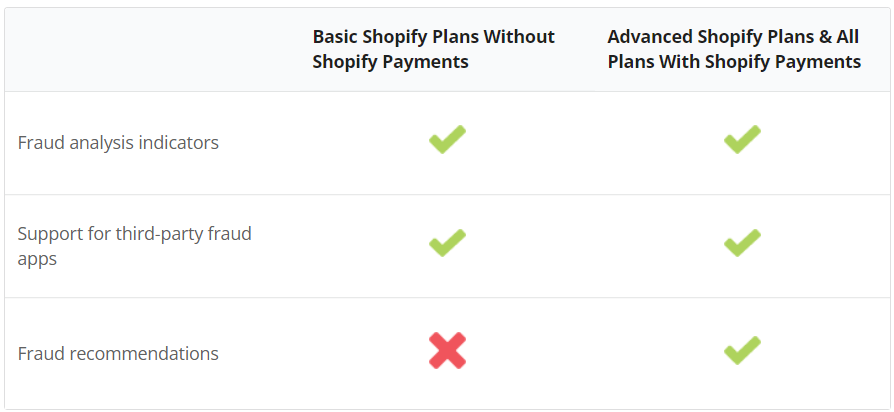

Built-in fraud detection is offered by Shopify. Feature availability is determined by the plan you are on. The overall outline is provided below. Below is a list of specifics.

You can look into possible fraudulent transactions using fraud analysis indicators by:

- Determining whether the address verification service (AVS) checks for the credit card used for the order were successful

- Examining the provided card security code to make sure it is accurate

- Revealing customer’s IP address information

- Notifying you of transactions when a customer attempted to use multiple payment cards

Additionally, you get access to an order’s complete analysis. This draws attention to a variety of actions and assists in identifying any possibly fraudulent conduct.

The Shopify App Store offers support for third-party fraud applications. With the integration of the Shopify fraud analysis tool for each order, these apps assist you in improving, personalizing, and adapting your strategy to preventing fraud.

Fraud recommendations aid in determining whether a chargeback resulting from fraud is likely for a given order. To ascertain whether an order may be fraudulent, this technology analyzes past transaction data from Shopify and utilizes machine learning to identify possibly fraudulent orders.

If an order carries a medium or high risk, it is given a warning icon on your Orders page and has the option of receiving an additional email warning. The order can then be verified, canceled, or refunded from there.

How to Prevent Chargebacks on Shopify

Although the possibility of chargebacks cannot entirely be eliminated, you can take precautions to minimize and prevent them.

- Start by comprehending and observing the guidelines provided by the card issuers and payment processors (like Shopify Payments). These guidelines explain your responsibilities and how to handle chargebacks.

- To prevent unhappy customers, examine your goods and services critically (and resulting chargebacks). Do you sell high-quality products? Do your product images and descriptions adequately represent what the customer will receive? Do you use client feedback to help you choose your products?

- By streamlining your fulfillment procedure, you can prevent chargebacks that assert a consumer never received an item or received an incorrect item. Quickly process and complete orders, then ship them using carriers that offer tracking information. Check your stock to make sure no customers are placing orders for items that are no longer available.

- Make sure your billing descriptions are clear so that clients can identify the purchase on their statements. As much truthful information as you can must be provided, and make sure it corresponds to the name of your brand.

- Put client service first. Provide policies that describe your refund and return procedures in clear, user-friendly, and accessible ways. Include references to these policies in any correspondence with your clients. Additionally, be sure to offer supportive customer service that aims to fix problems before they result in chargebacks.

Improving customer satisfaction can significantly reduce the likelihood of chargebacks. You should take other factors into account as well, though.

There are a number of chargeback prevention techniques available that are made with the purpose of preventing customer disputes from turning into chargebacks. It is typically wisest to employ a number of distinct solutions because each instrument tackles a particular phase of the dispute lifecycle.

Three options with a track record of success are as follows:

Order Validation: Customers can better comprehend their purchases with the aid of order validation technologies like Order Insight and Consumer Clarity. When doubts emerge, order validation offers details that should help to make the transaction clear and prevent the need for a chargeback.

Prevention Alerts: Preventative notifications stop disagreements in their tracks and give you time to repay the customer. A chargeback is not required after a transaction has been refunded.

Rapid Dispute Resolution (RDR): RDR offers an alternative resolution choice to issuing banks. Banks can employ RDR to instantly start a refund rather than the chargeback procedure.

Does Shopify offer chargeback protection?

Shopify Protect, a test solution created to combat fraud and offer chargeback protection, is only available to certain Shop Pay merchants.

The Shopify Protect algorithm leverages information gathered from all around the Shopify network to spot and stop fraudulent transactions. If a customer files a chargeback for fraud or because they didn’t recognize the order, and the order qualifies for Shopify Protect coverage, you will be compensated for the full cost of the order plus the chargeback fee.

To qualify for Shopify Protect coverage, an order must:

- Be a tangible item that needs to be shipped.

- Be carried out via Shop Pay

- Be acquired from a business in the US using an active Shopify Payments account in the US.

- Be processed and sent to the customer within seven days of the order being placed.

- Possess an accurate tracking number from Shopify Fulfillment Network, USPS, UPS, Canada Post, DHL Express, or FedEx, either directly or through Shopify Shipping.

Orders that are not covered by Shopify Protect proceed through the standard chargeback procedure.

How to Win Shopify Chargebacks

Creating a successful approach to combat Shopify chargebacks can preserve your revenue and aid in the expansion of your organization.

STEP ONE

Determine whether the dispute is valid first:

- A legitimate conflict arises when the client can make a solid argument against you. Criminal or purposeful fraud is one example, as is a client not receiving the thing they requested.

- When the customer does not have a solid argument against you, the disagreement is illegitimate. Examples include registering a chargeback after the chargeback period has past or engaging in “friendly” fraud.

STEP TWO

Collect Supporting Documentation

As soon as it is determined that the issue is without merit, you should start gathering evidence to support your position. Look up any case-specific criteria in the chargeback cause code. Example include:

- Copies of the transaction receipt, invoice, or order confirmation

- Tracking data and delivery confirmation

- IP address and geographic location of the shopper at the time and place of the transaction

- Messages between you and the client

- Evidence that you handled a refund for the concerned transaction

STEP THREE

Create a Letter of Rebuttal

Finally, put together a rebuttal letter that includes:

- providing specifics regarding the disputed chargeback, your company, and your merchant account number

- Information relevant to the dispute, such as the chargeback reason code, the client’s name, the amount of the transaction, and a breakdown of what was bought

- a general description of your company, the goods you sell, and the sales methods you employ

- Highlights of substantiating evidence that support your assertions

- A request for action expressing your wish for a chargeback cancellation

STEP FOUR

Submit the Response

organize all your documents and submit them to your processor.

Make sure you respond before the submission deadline (we recommend you send it three days before the deadline in case any follow up is needed).

STEP FIVE

Await the outcome

The issuer will make a decision after receiving and analyzing your response. This judgment establishes who is ultimately responsible for the chargeback. Results are typically made accessible 60 to 90 days from the date your response was submitted.

You might be able to request arbitration if you lose your fight. However, arbitration is a pricey and drawn-out procedure that ought to be saved for high-value deals.

STEP SIX

Optimize Your Processes

Whether you succeed or fail in fighting a chargeback, doing so might show you where your process needs work. Utilize analytics and data to find vulnerabilities and weaknesses.

For instance, you might want to review your shipping partners or fulfillment procedures if you’re getting a lot of chargebacks for claims of damages or misdelivery. Similar to this, improving the clarity of your billing description might reduce the amount of chargebacks you get from consumers who don’t understand the transaction.